VP, Director of Business Development

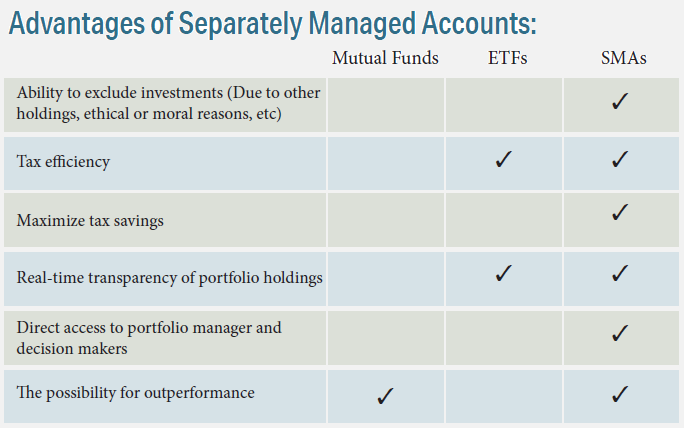

Most investors are familiar with mutual funds and exchange traded funds (ETF) and many have a large percentage of their overall portfolio invested in them. Mutual funds and ETFs are pooled investment vehicles registered with the SEC and subject to certain rules and regulations. These two investment types are comprised of individual securities, like stocks and bonds, and provide exposure to both niche markets and a wide variety of asset classes, and are easily available for purchase for small investment accounts. Mutual funds are generally actively managed by professional asset managers while ETFs are usually passively managed to replicate a specific market index, like the S&P 500. An alternative investment vehicle to a mutual fund or ETF which may not be as well-known, but we believe is superior in many ways, is a separately managed account or SMA.

Historically, SMAs have had large account minimums and have been used primarily by large institutions and the very wealthy. However, with advances in technology, the use of model delivery platforms, and dramatic decreases in transaction fees across the industry, SMAs minimums have dropped drastically (as low as $50,000 for Shaker’s strategies) and are poised for more mainstream adoption. SMAs have many of the same characteristics as mutual funds and ETFs with one primary difference: SMAs are not a pooled investment vehicle, but an account owned by an investor with individual positions held in the account. This means that an SMA investor owns the assets in the account directly as opposed to owning shares of a mutual fund or ETF with underlying ownership. This structure allows for more flexibility, transparency, and tax efficiency for the SMA investor.

Greater flexibility

One of the benefits of investing in SMAs is investors have direct ownership of the assets purchased in their accounts. Direct ownership of assets allows SMA investors greater flexibility to dictate the holdings in the account. Investors can work through their investment advisor or directly with the SMA portfolio manager to make decisions on account holdings. This is beneficial if investors wish to avoid certain sectors, industries, or individual securities to which they may already have exposure. For example, consider high level executives at Progressive Insurance. They may wish to avoid additional exposure to the financial service sector, the insurance industry, or Progressive Insurance public equity due to already high exposure to those things through their employer.

Value-based investing

Many investors want their portfolios to reflect their values. One of the fastest growing trends in the industry is ESG investing, which is evaluating companies on environmental, social, and governance factors in addition to traditional investment factors to make investment decisions. Flexibility in an SMA allows investors to avoid investing in companies to which they have a moral objection, for example avoiding handgun manufacturing companies because of their impact on public safety.

Better tax management

In a mutual fund, capital gains accrued from trading activities of the fund manager are passed through to all the investors in the fund. Mutual fund holders are often surprised to learn that they have realized gains at the end of the year despite having not sold any shares of the mutual fund they own. With an SMA, an investor is only taxed on the realized gains specific to his or her account.

There are many techniques portfolio managers can use to create tax alpha in a SMA portfolio that cannot be utilized in a mutual fund. One way portfolio managers can minimize capital gains taxes for the year is tax loss harvesting. Tax loss harvesting is selling a position that has gone down in value since the original purchase, realizing a loss to offset some gains. Portfolio managers must be cautious not to enter into a wash sale or purchasing the position back within 30 days.

Greater transparency

Unlike mutual funds who are only required to disclose their holdings on a quarterly basis, with a SMA portfolio, an investor sees every holding in the portfolio and every transaction the portfolio manager makes. Management costs can also be a cloudy area for mutual funds and ETFs where you must seek fund prospectus to identify the costs of each fund. SMAs offer maximum transparency since they post an individual transaction for each management fee payment. Broad portfolio reporting from the SMA custodian and professional portfolio manager provides investors with a lot of useful information about their investments on a monthly or quarterly basis. With the prevalence of online brokerage accounts investors have access to this information almost instantaneously.

Access to the portfolio manager

Direct access to the portfolio manager is considered essential by most sophisticated investors. Conversations with portfolio managers can be central to understanding an investment strategy. A major benefit for SMA investors is the ability to have a working relationship with the portfolio manager. In fact, the advantages mentioned above are highly reliant on investors communicating with the portfolio manager. This level of access and service is rarely offered by mutual funds and ETFs. Fund portfolio managers are usually only available for the largest investors, and everyone else must speak to a sales representative, or worse, a call center. If access is a priority, it is important to choose a manager that you know and trust, and that will be responsive to your inquiries. Additionally, conducting your own research and due diligence as an investor, just as you would with managers of your mutual fund or ETF, is essential to the process.

At Shaker Investments, we have been offering this vehicle to our clients since the firm’s inception. We believe SMA’s offer clear advantages over other investment vehicles for those who meet the account minimums, want more control and customization of their portfolios. Every client is unique and your portfolio should be equally individualized and aligned with your personal financial goals.